Many lenders supply on-line loans with month-to-month funds. These lenders function on-line and will even have bodily areas. There are fairly a number of on-line loans which have fast functions and determination processes. You could even get funds deposited in your checking account the identical day you apply. Here is what it’s best to learn about how these loans work, the advantages, and the choices obtainable.

APPLY NOW

Methods to Get On-line Loans with Month-to-month Funds

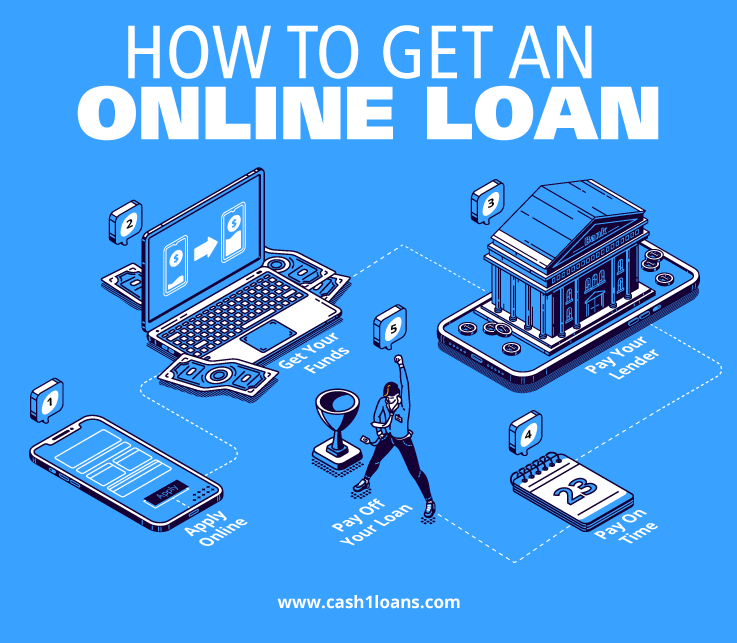

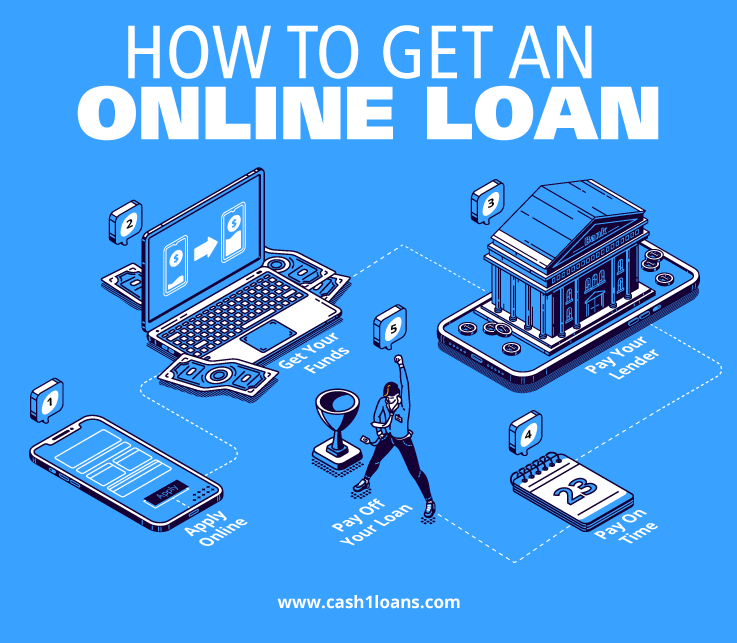

Whereas on-line lender processes could fluctuate, listed below are the commonest steps you possibly can count on to take while you apply:

- Whenever you apply for a mortgage on-line, the lender will request private and monetary info by way of a web-based software. Your identify, contact info, date of start, checking account, employment standing, and revenue are normally required.

- If accredited, you may obtain your funds by way of a financial institution switch. The method might take a number of enterprise days or the identical day you utilized.

- When you get the mortgage, you may should pay it again with curiosity. The funds will likely be due as soon as a month.

- Relying on the phrases and circumstances of your mortgage, the lender will report optimistic info to credit score bureaus in case you make on-time funds. When you pay late or fail to repay the mortgage, the lender will report dangerous information to the credit score bureaus.

- When you totally repay the mortgage, the account will likely be closed.

Kinds of On-line Loans With Month-to-month Funds

There are numerous choices for month-to-month on-line loans, together with, however not restricted to:

Installment loans

Most often, installment loans supply inexpensive rates of interest and don’t have any prepayment penalties. With an installment mortgage, you borrow a set amount of cash and repay it over time with mounted month-to-month funds over a number of months or years.

Traces of credit score

When you’re in search of one thing extra versatile, a line of credit score might give you the results you want. After approval, you withdraw as little or as a lot as you want as much as your set credit score restrict. You solely pay curiosity on the quantity that you just borrow.

Title loans

If in case you have a transparent car title, you possibly can change it for money with a title mortgage. You retain driving your automotive as you repay the mortgage. They’re secured loans utilizing your automotive title as collateral.

Auto loans

Whenever you buy a automotive, you may normally want an auto mortgage. You will get them by way of dealerships, banks, or credit score unions. Most of those loans are paid month-to-month and have phrases from 12 to 96 months. Your newly bought car acts as collateral in opposition to that mortgage. A lender has the authorized proper to repossess your automotive in case you fail to fulfill the compensation necessities. As with every mortgage, learn the phrases and circumstances earlier than signing the ultimate paperwork.

Mortgages

Mortgages are secured installment loans utilizing borrowed cash to purchase a residential property. The phrases on mortgages fluctuate, going as much as 30 years. As a result of they’re secured, your new house is used as collateral to ensure your mortgage. So, in case you fail to make funds, you possibly can lose your own home.

What to Ask Your self Earlier than Making use of for an On-line Mortgage

When you’re fascinated about making use of for a mortgage on-line, there are some questions it’s best to ask your self earlier than you even begin.

Why do I want this mortgage?

The primary query to ask your self is in case you want a mortgage. Utilizing the additional cash to purchase one thing you need and do not want shouldn’t be a sound monetary determination. Additionally, contemplate the quantity you want and solely borrow what you possibly can afford.

What’s my credit score rating?

Many lenders have a look at elements moreover your credit score rating to evaluate your skill to repay the mortgage. However, relying on the lender you select, your credit score rating might play an element. Your rating might additionally decide your mortgage quantity. Both method, realizing the place you stand relating to your credit score is important.

Do I’ve the required documentation prepared?

When you apply for a web-based mortgage, you may want to produce particular info. Necessities could fluctuate between lenders, however most will want some type of legitimate identification, proof of revenue, and proof of residency. Having the whole lot you want might velocity up the appliance course of and get you the funds faster.

APPLY NOW

Execs & Cons of On-line Loans with Month-to-month Funds

Earlier than making use of for a mortgage, contemplate these advantages and disadvantages.

Execs

Comfort

You’ll be able to apply in your mortgage on-line from house as an alternative of going to the financial institution and talking with a mortgage officer. The method is comparatively easy, and if it is advisable to, it can save you the updates and return to the net software later.

Quick turnaround time

On-line loans typically have a quick turnaround time in case you want fast funds. As soon as the lender approves your software, you possibly can obtain your funds on the identical day or inside 24 hours.

Probably low-interest charges and charges

On-line loans could have low-interest charges or no origination charges. Nonetheless, your charges usually rely in your general monetary profile and creditworthiness. In case your monetary profile and credit score rating aren’t the strongest, contemplate a lender that enables cosigners or joint debtors.

On the spot fee quotes

Most on-line lenders supply the choice of pre-approval while you enter some important info. You will see in case you prequalify for a mortgage. You will get an thought of the phrases and charges by finishing the appliance. These firms carry out a smooth credit score verify throughout pre-approval, so your credit score rating will not be affected.

Cons

Safety considerations

Submitting your private info on-line could be dangerous in case you do not work with a good lender. When you really feel assured borrowing from a web-based lending firm, solely use its official web site and browse its safety coverage. Suppose you do obtain an unsolicited name asking in your private info. In that case, it almost definitely is a rip-off and never an individual affiliated with the lender.

Lack of loyalty reductions

Banks could supply rate of interest reductions or rewards applications to their clients. On-line lenders usually do not supply reductions. Some, nonetheless, supply a decrease rate of interest in your mortgage in case you enroll in an auto-pay program.

No face-to-face customer support

With a web-based mortgage firm, you’ll doubtless have the ability to communicate to a consultant over the cellphone, chat, or e mail. However suppose you get pleasure from doing just some issues on-line. You would select a financial institution, credit score union, or on-line lender with bodily areas.

Methods to Examine On-line Loans With Month-to-month Funds

Evaluating lenders could be overwhelming. As you analysis, it’s best to hold these questions in thoughts to decide on the correct on-line mortgage.

What’s the annual share fee (APR)?

Examine to see in case you can prequalify for the mortgage to know your approval odds and obtain an estimated APR, mortgage quantity, and month-to-month cost. Then, you possibly can examine different prequalified affords earlier than you apply.

How briskly is the funding?

When you require cash quick, examine lenders based mostly on their funding time. You will discover that some could take a number of days to course of your mortgage, whereas others supply next-day and even same-day funding.

What’s the mortgage quantity?

Know every lender’s most and minimal mortgage quantities, however do not forget that how a lot you possibly can borrow is dependent upon your creditworthiness. Solely borrow what you want and might afford to repay. Lenders normally have on-line cost calculators so you possibly can decide your month-to-month prices at totally different mortgage quantities.

What’s the compensation interval?

The mortgage time period varies based mostly in your creditworthiness, lender, and mortgage kind. Select a lender with the shortest compensation phrases you possibly can afford. You will repay the mortgage sooner and lower your expenses on the curiosity that does not accrue.

What is the popularity of the lender?

Examine evaluations and rankings on-line, and ask family and friends in regards to the lenders. It will assist in case you obtained suggestions about charges and customer support.

Does the mortgage have any particular options?

Some on-line loans could have versatile cost dates. Discover out in case you can add a cosigner, repay the steadiness early, or refinance for a decrease APR later.

APPLY NOW

Conclusion

On-line lending is new in comparison with conventional banking. Nonetheless, the comfort of borrowing cash within the consolation of your own home is gaining popularity. Making an informed determination about the correct on-line mortgage for you is important. Following the above ideas will enable you to select a secure on-line lending firm, so you’ll really feel assured with borrowing from a web-based lender.

Many lenders supply on-line loans with month-to-month funds. These lenders function on-line and will even have bodily areas. There are fairly a number of on-line loans which have fast functions and determination processes. You could even get funds deposited in your checking account the identical day you apply. Here is what it’s best to learn about how these loans work, the advantages, and the choices obtainable.

APPLY NOW

Methods to Get On-line Loans with Month-to-month Funds

Whereas on-line lender processes could fluctuate, listed below are the commonest steps you possibly can count on to take while you apply:

- Whenever you apply for a mortgage on-line, the lender will request private and monetary info by way of a web-based software. Your identify, contact info, date of start, checking account, employment standing, and revenue are normally required.

- If accredited, you may obtain your funds by way of a financial institution switch. The method might take a number of enterprise days or the identical day you utilized.

- When you get the mortgage, you may should pay it again with curiosity. The funds will likely be due as soon as a month.

- Relying on the phrases and circumstances of your mortgage, the lender will report optimistic info to credit score bureaus in case you make on-time funds. When you pay late or fail to repay the mortgage, the lender will report dangerous information to the credit score bureaus.

- When you totally repay the mortgage, the account will likely be closed.

Kinds of On-line Loans With Month-to-month Funds

There are numerous choices for month-to-month on-line loans, together with, however not restricted to:

Installment loans

Most often, installment loans supply inexpensive rates of interest and don’t have any prepayment penalties. With an installment mortgage, you borrow a set amount of cash and repay it over time with mounted month-to-month funds over a number of months or years.

Traces of credit score

When you’re in search of one thing extra versatile, a line of credit score might give you the results you want. After approval, you withdraw as little or as a lot as you want as much as your set credit score restrict. You solely pay curiosity on the quantity that you just borrow.

Title loans

If in case you have a transparent car title, you possibly can change it for money with a title mortgage. You retain driving your automotive as you repay the mortgage. They’re secured loans utilizing your automotive title as collateral.

Auto loans

Whenever you buy a automotive, you may normally want an auto mortgage. You will get them by way of dealerships, banks, or credit score unions. Most of those loans are paid month-to-month and have phrases from 12 to 96 months. Your newly bought car acts as collateral in opposition to that mortgage. A lender has the authorized proper to repossess your automotive in case you fail to fulfill the compensation necessities. As with every mortgage, learn the phrases and circumstances earlier than signing the ultimate paperwork.

Mortgages

Mortgages are secured installment loans utilizing borrowed cash to purchase a residential property. The phrases on mortgages fluctuate, going as much as 30 years. As a result of they’re secured, your new house is used as collateral to ensure your mortgage. So, in case you fail to make funds, you possibly can lose your own home.

What to Ask Your self Earlier than Making use of for an On-line Mortgage

When you’re fascinated about making use of for a mortgage on-line, there are some questions it’s best to ask your self earlier than you even begin.

Why do I want this mortgage?

The primary query to ask your self is in case you want a mortgage. Utilizing the additional cash to purchase one thing you need and do not want shouldn’t be a sound monetary determination. Additionally, contemplate the quantity you want and solely borrow what you possibly can afford.

What’s my credit score rating?

Many lenders have a look at elements moreover your credit score rating to evaluate your skill to repay the mortgage. However, relying on the lender you select, your credit score rating might play an element. Your rating might additionally decide your mortgage quantity. Both method, realizing the place you stand relating to your credit score is important.

Do I’ve the required documentation prepared?

When you apply for a web-based mortgage, you may want to produce particular info. Necessities could fluctuate between lenders, however most will want some type of legitimate identification, proof of revenue, and proof of residency. Having the whole lot you want might velocity up the appliance course of and get you the funds faster.

APPLY NOW

Execs & Cons of On-line Loans with Month-to-month Funds

Earlier than making use of for a mortgage, contemplate these advantages and disadvantages.

Execs

Comfort

You’ll be able to apply in your mortgage on-line from house as an alternative of going to the financial institution and talking with a mortgage officer. The method is comparatively easy, and if it is advisable to, it can save you the updates and return to the net software later.

Quick turnaround time

On-line loans typically have a quick turnaround time in case you want fast funds. As soon as the lender approves your software, you possibly can obtain your funds on the identical day or inside 24 hours.

Probably low-interest charges and charges

On-line loans could have low-interest charges or no origination charges. Nonetheless, your charges usually rely in your general monetary profile and creditworthiness. In case your monetary profile and credit score rating aren’t the strongest, contemplate a lender that enables cosigners or joint debtors.

On the spot fee quotes

Most on-line lenders supply the choice of pre-approval while you enter some important info. You will see in case you prequalify for a mortgage. You will get an thought of the phrases and charges by finishing the appliance. These firms carry out a smooth credit score verify throughout pre-approval, so your credit score rating will not be affected.

Cons

Safety considerations

Submitting your private info on-line could be dangerous in case you do not work with a good lender. When you really feel assured borrowing from a web-based lending firm, solely use its official web site and browse its safety coverage. Suppose you do obtain an unsolicited name asking in your private info. In that case, it almost definitely is a rip-off and never an individual affiliated with the lender.

Lack of loyalty reductions

Banks could supply rate of interest reductions or rewards applications to their clients. On-line lenders usually do not supply reductions. Some, nonetheless, supply a decrease rate of interest in your mortgage in case you enroll in an auto-pay program.

No face-to-face customer support

With a web-based mortgage firm, you’ll doubtless have the ability to communicate to a consultant over the cellphone, chat, or e mail. However suppose you get pleasure from doing just some issues on-line. You would select a financial institution, credit score union, or on-line lender with bodily areas.

Methods to Examine On-line Loans With Month-to-month Funds

Evaluating lenders could be overwhelming. As you analysis, it’s best to hold these questions in thoughts to decide on the correct on-line mortgage.

What’s the annual share fee (APR)?

Examine to see in case you can prequalify for the mortgage to know your approval odds and obtain an estimated APR, mortgage quantity, and month-to-month cost. Then, you possibly can examine different prequalified affords earlier than you apply.

How briskly is the funding?

When you require cash quick, examine lenders based mostly on their funding time. You will discover that some could take a number of days to course of your mortgage, whereas others supply next-day and even same-day funding.

What’s the mortgage quantity?

Know every lender’s most and minimal mortgage quantities, however do not forget that how a lot you possibly can borrow is dependent upon your creditworthiness. Solely borrow what you want and might afford to repay. Lenders normally have on-line cost calculators so you possibly can decide your month-to-month prices at totally different mortgage quantities.

What’s the compensation interval?

The mortgage time period varies based mostly in your creditworthiness, lender, and mortgage kind. Select a lender with the shortest compensation phrases you possibly can afford. You will repay the mortgage sooner and lower your expenses on the curiosity that does not accrue.

What is the popularity of the lender?

Examine evaluations and rankings on-line, and ask family and friends in regards to the lenders. It will assist in case you obtained suggestions about charges and customer support.

Does the mortgage have any particular options?

Some on-line loans could have versatile cost dates. Discover out in case you can add a cosigner, repay the steadiness early, or refinance for a decrease APR later.

APPLY NOW

Conclusion

On-line lending is new in comparison with conventional banking. Nonetheless, the comfort of borrowing cash within the consolation of your own home is gaining popularity. Making an informed determination about the correct on-line mortgage for you is important. Following the above ideas will enable you to select a secure on-line lending firm, so you’ll really feel assured with borrowing from a web-based lender.