As the only income earner in your household, or as a single individual, sole breadwinner stress can show up suddenly in your life and then be difficult to shake. This is especially true if your spouse has recently lost their job and you’ve become the new breadwinner in the family. Sole breadwinner stress can also strike when you’re faced with an unexpected expense like a household or car repair. While this is a common issue, high levels of stress can be harmful to your health if left unaddressed.

In this article, we’ll define what it means to be a sole breadwinner and how the role has shifted over the past few years to include a greater number of women. We’ll also offer seven tips to help you manage sole breadwinner stress and avoid burnout and other health issues. Hint: Working with a financial advisor can help.

Has your financial situation changed recently? Schedule a call with Bay Point Wealth to find out how we can help create your new budget and financial plan, so you can stay on track toward your goals.

What Does It Mean To Be A Sole Breadwinner?

The sole provider meaning is simple: You are the only individual in your household who earns an income. Whether you’re single or part of a couple, you can be a sole breadwinner—and if you are in this role, you’ve likely experienced the stress that comes along with it at some point in your life.

The sole breadwinner phenomenon is common in America: “In just over 20% of couples, the man alone is in the labor force, and in just under 10%, only the woman is in the labor force,” according to this article by the Guardian. In addition, 31% of U.S. adults are single and don’t have a spouse’s income to support them should they lose their job or be unable to work.

Challenges Of The Breadwinner Role

Individuals in the breadwinner role often feel immense pressure to provide for their families and a sense of fear around what could happen if they had to take time off work due to illness or injury—or if they suddenly became unemployed. Others feel burnt out in their demanding careers and often don’t get to spend enough time at home, with their children, or doing other activities that allow them to have fun and relax.

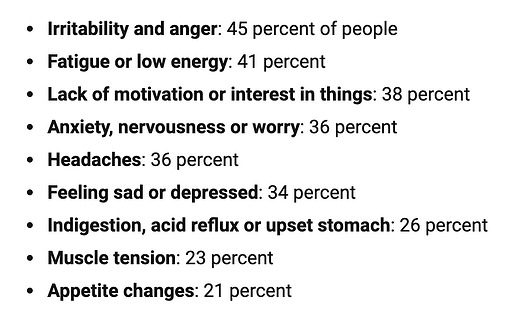

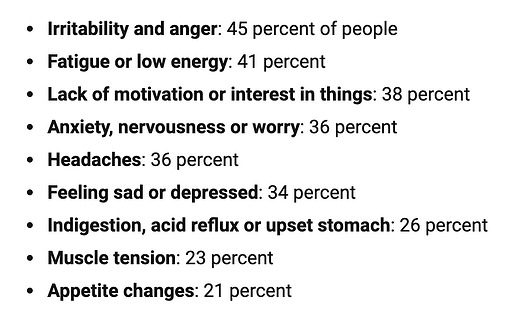

The effects of sole breadwinner stress—and stress in general—are detrimental to your health. According to research from the American Institute of Stress, “77% of people experience stress that affects their physical health; 73% of people have stress that impacts their mental health, and 48% of people have trouble sleeping because of stress.” These effects make it difficult to escape the stress cycle, which can cause myriad symptoms, including:

[Image Source]

The Shifting Breadwinner Role

Historically, men have typically held the breadwinner role in their families. However, women are now the primary earners in 40% of U.S. households. Among those women, 63% are single mothers and 37% bring in more money than their partner.

Whether someone is the new breadwinner in the family or has been in the role for years, men and women tend to handle sole breadwinner stress differently. According to research from the University of Connecticut, “when men make more money than their spouses, their self-reported psychological well-being and health go down.”

Female breadwinners certainly don’t have it easy, either. Career women with male partners usually shoulder greater household responsibilities, which has led to widespread burnout among women in the workforce—more so than their male counterparts report experiencing. Clearly, sole breadwinner stress has negative effects on everyone who faces the issue.

7 Tips To Help Alleviate Sole Breadwinner Stress

1. Take a preventative approach.

Familiarize yourself with signs of stress and burnout so you can be vigilant about stopping them in their tracks when you begin to feel overwhelmed. Talk to your family and friends, too, so they can help look out for your health.

2. Don’t be afraid to say “no.”

When you’re used to having a lot on your plate, you can become conditioned to feel like you should be able to handle anything. Practice setting boundaries in your personal life and in your professional life. This may require working on your mindset to untangle your sense of self from your career. You deserve to relax and recharge.

3. Prioritize your health.

You may feel pressure to stay trapped in the cycle of sole breadwinner stress for financial reasons. However, your intentions could backfire on you in the long term if your health deteriorates to the point that you need to take time away from work. This could also cause you to incur expensive medical bills and suffer from chronic health issues that impact your quality of life. Put your health first, and be sure you’re getting enough sleep and exercise.

4. Ask for help at home and at the office.

Figure out which tasks in your life you can outsource. This is especially important if you don’t have a partner with whom you can split household responsibilities. For example, consider hiring someone to clean your house or an assistant at work if your employer will allow you to do so. With today’s technology, conveniences like grocery delivery are just a click away.

5. Explore a different path.

Even after you’ve tried the previous tips, you may find that sole breadwinner stress continues to be a problem. In this case, you’d be wise to seriously consider how you can change your current situation and make it more conducive to a happy, healthy life. This might mean switching jobs or even changing careers. Or, if the root of the issue lies in your personal life, you may need to ask your family and friends for help, or seek guidance from a professional.

6. Talk to your financial advisor.

Many individuals in the breadwinner role feel like they can’t leave their jobs even if they want to—that is, until they sit down with their financial advisor and run the numbers. At Bay Point Wealth, our clients are often pleasantly surprised when we look at their financial plan and see how much money they really need to earn to support themselves or their family and continue to work toward their future goals.

7. Normalize the issue of sole breadwinner stress.

A cultural shift has begun to happen among millennials (people born between 1981 and 1996, now in their mid-20s to age 40) that has brought the struggles of breadwinner stress out into the open. This is leading to conversations that are helping couples find ways to better share the household responsibilities of both raising children and earning income. It’s important for all genders to know that they can talk about and receive support for the issue of sole breadwinner stress.

Thoughtful Financial Advice For Sole Breadwinners

At Bay Point Wealth, we provide our clients with expert, objective, and caring advice to help them through difficult situations like dealing with sole breadwinner stress. We will always listen to your perspective and work diligently to find a solution that meets your and your family’s needs. Schedule a call with us today to find out how we can work together to help you alleviate stress while still working toward your ideal financial future.

As the only income earner in your household, or as a single individual, sole breadwinner stress can show up suddenly in your life and then be difficult to shake. This is especially true if your spouse has recently lost their job and you’ve become the new breadwinner in the family. Sole breadwinner stress can also strike when you’re faced with an unexpected expense like a household or car repair. While this is a common issue, high levels of stress can be harmful to your health if left unaddressed.

In this article, we’ll define what it means to be a sole breadwinner and how the role has shifted over the past few years to include a greater number of women. We’ll also offer seven tips to help you manage sole breadwinner stress and avoid burnout and other health issues. Hint: Working with a financial advisor can help.

Has your financial situation changed recently? Schedule a call with Bay Point Wealth to find out how we can help create your new budget and financial plan, so you can stay on track toward your goals.

What Does It Mean To Be A Sole Breadwinner?

The sole provider meaning is simple: You are the only individual in your household who earns an income. Whether you’re single or part of a couple, you can be a sole breadwinner—and if you are in this role, you’ve likely experienced the stress that comes along with it at some point in your life.

The sole breadwinner phenomenon is common in America: “In just over 20% of couples, the man alone is in the labor force, and in just under 10%, only the woman is in the labor force,” according to this article by the Guardian. In addition, 31% of U.S. adults are single and don’t have a spouse’s income to support them should they lose their job or be unable to work.

Challenges Of The Breadwinner Role

Individuals in the breadwinner role often feel immense pressure to provide for their families and a sense of fear around what could happen if they had to take time off work due to illness or injury—or if they suddenly became unemployed. Others feel burnt out in their demanding careers and often don’t get to spend enough time at home, with their children, or doing other activities that allow them to have fun and relax.

The effects of sole breadwinner stress—and stress in general—are detrimental to your health. According to research from the American Institute of Stress, “77% of people experience stress that affects their physical health; 73% of people have stress that impacts their mental health, and 48% of people have trouble sleeping because of stress.” These effects make it difficult to escape the stress cycle, which can cause myriad symptoms, including:

[Image Source]

The Shifting Breadwinner Role

Historically, men have typically held the breadwinner role in their families. However, women are now the primary earners in 40% of U.S. households. Among those women, 63% are single mothers and 37% bring in more money than their partner.

Whether someone is the new breadwinner in the family or has been in the role for years, men and women tend to handle sole breadwinner stress differently. According to research from the University of Connecticut, “when men make more money than their spouses, their self-reported psychological well-being and health go down.”

Female breadwinners certainly don’t have it easy, either. Career women with male partners usually shoulder greater household responsibilities, which has led to widespread burnout among women in the workforce—more so than their male counterparts report experiencing. Clearly, sole breadwinner stress has negative effects on everyone who faces the issue.

7 Tips To Help Alleviate Sole Breadwinner Stress

1. Take a preventative approach.

Familiarize yourself with signs of stress and burnout so you can be vigilant about stopping them in their tracks when you begin to feel overwhelmed. Talk to your family and friends, too, so they can help look out for your health.

2. Don’t be afraid to say “no.”

When you’re used to having a lot on your plate, you can become conditioned to feel like you should be able to handle anything. Practice setting boundaries in your personal life and in your professional life. This may require working on your mindset to untangle your sense of self from your career. You deserve to relax and recharge.

3. Prioritize your health.

You may feel pressure to stay trapped in the cycle of sole breadwinner stress for financial reasons. However, your intentions could backfire on you in the long term if your health deteriorates to the point that you need to take time away from work. This could also cause you to incur expensive medical bills and suffer from chronic health issues that impact your quality of life. Put your health first, and be sure you’re getting enough sleep and exercise.

4. Ask for help at home and at the office.

Figure out which tasks in your life you can outsource. This is especially important if you don’t have a partner with whom you can split household responsibilities. For example, consider hiring someone to clean your house or an assistant at work if your employer will allow you to do so. With today’s technology, conveniences like grocery delivery are just a click away.

5. Explore a different path.

Even after you’ve tried the previous tips, you may find that sole breadwinner stress continues to be a problem. In this case, you’d be wise to seriously consider how you can change your current situation and make it more conducive to a happy, healthy life. This might mean switching jobs or even changing careers. Or, if the root of the issue lies in your personal life, you may need to ask your family and friends for help, or seek guidance from a professional.

6. Talk to your financial advisor.

Many individuals in the breadwinner role feel like they can’t leave their jobs even if they want to—that is, until they sit down with their financial advisor and run the numbers. At Bay Point Wealth, our clients are often pleasantly surprised when we look at their financial plan and see how much money they really need to earn to support themselves or their family and continue to work toward their future goals.

7. Normalize the issue of sole breadwinner stress.

A cultural shift has begun to happen among millennials (people born between 1981 and 1996, now in their mid-20s to age 40) that has brought the struggles of breadwinner stress out into the open. This is leading to conversations that are helping couples find ways to better share the household responsibilities of both raising children and earning income. It’s important for all genders to know that they can talk about and receive support for the issue of sole breadwinner stress.

Thoughtful Financial Advice For Sole Breadwinners

At Bay Point Wealth, we provide our clients with expert, objective, and caring advice to help them through difficult situations like dealing with sole breadwinner stress. We will always listen to your perspective and work diligently to find a solution that meets your and your family’s needs. Schedule a call with us today to find out how we can work together to help you alleviate stress while still working toward your ideal financial future.